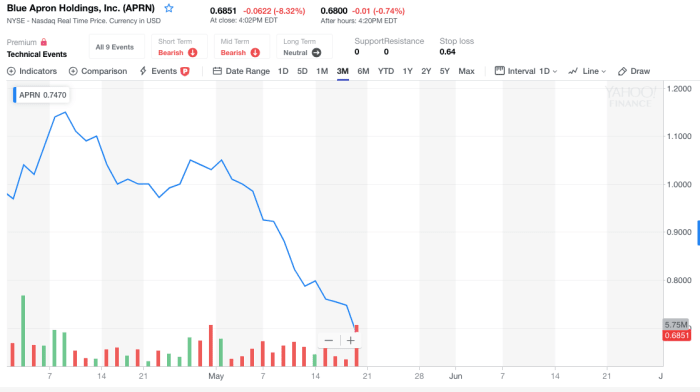

The opinions expressed in this article are those of the writer, subject to the Publishing Guidelines. On the date of publication, Shrey Dua did not hold (either directly or indirectly) any positions in the securities mentioned in this article. Whether APRN makes the climb to the levels Citron predicts remains to be seen. Notably, the company is still trading below even last month’s high of $12.80. All that has changed and the terms are meaningful.”Ĭitron’s report prompted an immediate jump for the meal-kit service. This left them with little cash going into 2020. “Blue Apron was not able to grow proportionally during the pandemic because previous management ran the company into the ground as they focused more on building the infrastructure and did not focus on customer acquisition costs. Citron argues that Blue Apron enjoys higher margins and increased usage from customers than HelloFresh.Īdditionally, Citron believes its recent management changes reflect a complete restructuring of the company’s business model, for the better. For example, industry leader HelloFresh (OTCMKTS: HLFF) is valued at more than $10 billion, compared to APRN’s $160 million. As such, “bullish” hardly encapsulates Citron’s $40 price target.Ĭitron claims that compared to other similarly popular meal-kit services, Blue Apron’s market capitalization doesn’t come close to measuring its potential. Blue Apron ( NYSE: APRN) stock sank as much as 46.5 on Monday after the firm guided Q3 revenue well below Street estimates and flagged going concern risks. APRN has dropped as low as $3.52 per share, and even after a strong performance today, it is only at $7.90. This isn’t the only logic behind Citron’s prediction, however.Ĭitron Claims APRN Stock Is Blatantly UndervaluedĪfter opening at $140 in 2017, Blue Apron has seen its stock price progressively decline. To add to the consumer trend, Blue Apron frequently tops many meal kit reviews in terms of quality, price and ease of use. The latest price target for Blue Apron Hldgs (NYSE: APRN) was reported by Lake Street on Wednesday, August 10, 2022. This comes as grocery store costs are estimated to increase by nearly 15% this year.

Apparently, roughly 61% of those surveyed intend to use meal kits more often in 2022. According to Citron, the benefits of going to the supermarket for food “is making less and less sense.” A recent survey from KPMG on food costs backs its claim. The basis of their bullishness? Strong fundamentals and rising food costs. They even quote a lofty tweet from investor Joe Sanberg on the meal service company: “Blue Apron is going to prove to be one of the greatest corporate turnaround stories of this century!” The research company claims the food industry has the potential to beat out the metaverse, crypto and electric vehicles (EVs). What’s behind Citron’s latest advocating report?Ĭitron pulls no punches in its presentation backing its whopping $40 price target. It also operates Blue Apron Market, an e-commerce market that provides cooking tools, utensils, pantry items, and other products. operates a direct-to-consumer platform that delivers original recipes with fresh and seasonal ingredients. Address: 28 Liberty Street, New York, NY, United States, 10005 Read Lessīlue Apron Holdings, Inc. MD, PhD Jessica McCool Nicole Mori, RN, BSN, APRN-BC Teri Pearlstein. was founded in 2012 and is headquartered in New York, New York. TARGET AUDIENCE All practicing physicians and other healthcare professionals. The company offers its services through order selections on Website or mobile application primarily in the United States. It serves young couples, families, singles, and empty nesters.

In addition, the company offers Blue Apron Wine, a direct-to-consumer wine delivery service that sells wines, which can be paired with its meals.

0 kommentar(er)

0 kommentar(er)